Budgeting and money management are the processes of creating a spending plan and tracking expenses to help achieve financial stability. It involves setting aside money for necessary expenses, paying bills on time, and saving for future financial goals. This helps you to stay within your means, avoid overspending and debt, and plan for financial security. By managing money effectively, you can increase your ability to save, invest, and achieve financial stability over time.

Top 5 Essential Tips to Establish a Solid Budgeting Plan

Determine your income: Start by calculating your monthly income from all sources, including salary, bonuses, and any additional sources of income.

Track your spending: Keep track of all your expenses for a month to get a clear understanding of where your money is going.

Create a budget: Based on your income and expenses, create a budget that allocates funds for necessary expenses, savings, and discretionary spending.

Stay disciplined: Stick to your budget and avoid overspending by monitoring your spending regularly and making adjustments as needed.

Adjust and reassess: Regularly review your budget to see where you can make adjustments, and make changes as your income and expenses change. Be flexible, but stay committed to reaching your financial goals.

How to Manage Your Money for Maximum Savings & Growth

Prioritize savings: Make saving a top priority by automatically transferring a portion of your income into a savings account each month.

Minimize debt: Pay off high-interest debt as soon as possible and avoid taking on new debt.

Create an emergency fund: Set aside funds for unexpected expenses to avoid dipping into savings or going into debt.

Invest for growth: Consider investing in a diversified portfolio of assets, such as stocks, bonds, and real estate, to grow your wealth over time.

Seek professional advice: Consider working with a financial advisor to develop a personalized investment strategy that aligns with your financial goals and risk tolerance.

Review and adjust: Regularly review your financial progress and make adjustments as needed to ensure you are staying on track to meet your financial goals.

3 Essential Strategies for Reducing Debt and Improving Credit Score

Budgeting: Create a budget to track your spending and prioritize paying down debt. Allocate extra funds towards paying off debt each month.

Debt repayment plan: Develop a debt repayment plan that prioritizes paying off high-interest debt first, such as credit card debt.

Avoid taking on new debt: Avoid taking on new debt and limit spending to necessities while you work to pay off existing debt.

Make timely payments: Make all debt and bill payments on time to avoid late fees and negative marks on your credit report.

Check credit report regularly: Monitor your credit report regularly to ensure accuracy and dispute any errors.

Limit credit card usage: Limit the use of credit cards and pay the full balance each month to avoid interest charges and maintain a healthy credit utilization ratio.

What are the Best Budgeting & Money Management Apps & Websites on the Market?

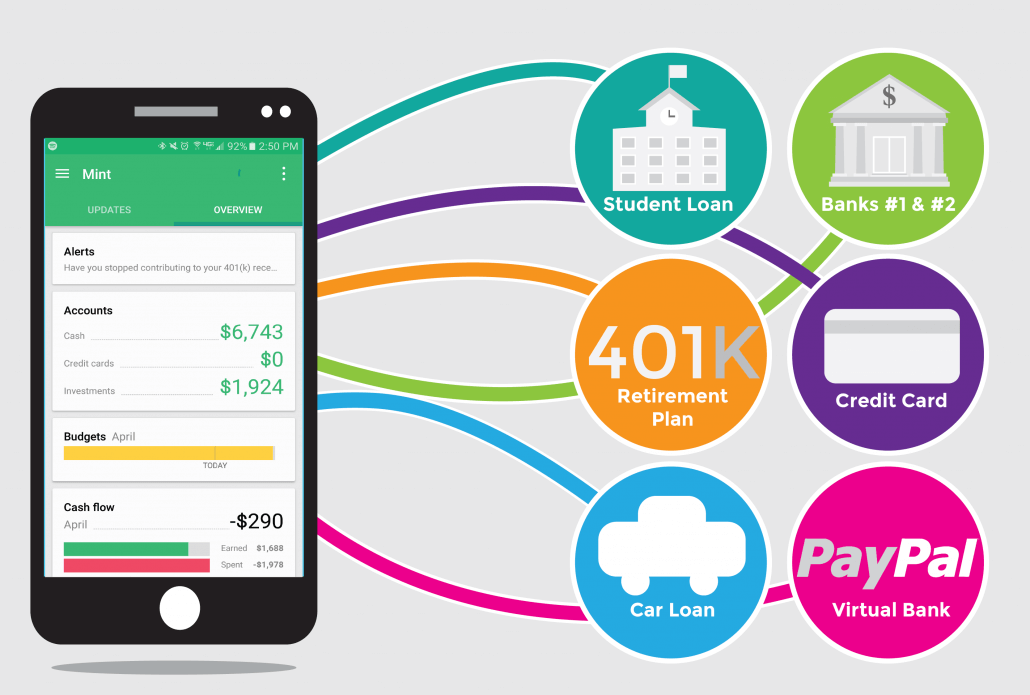

Mint: A comprehensive personal finance app that allows you to track spending, create budgets, and manage investments.

Personal Capital: A financial planning and tracking app that provides investment analysis, retirement planning, and budgeting tools.

YNAB (You Need a Budget): A budgeting app that focuses on helping users plan and prioritize spending based on their financial goals.

PocketGuard: A budgeting app that provides a simple, easy-to-use interface for tracking spending and creating a budget.

Wally: A personal finance app that helps track expenses, create a budget, and manage finances on-the-go.

Acebudget: A budgeting app that allows users to set spending limits, track expenses, and categorize transactions.

In conclusion, taking control of your finances requires a proactive approach and commitment to change. By setting financial goals, creating a budget, tracking spending, paying off debt, and saving for emergencies, you can improve your financial stability and work towards achieving financial freedom. Remember to regularly review and adjust your financial plan as needed, and seek professional advice if necessary. Start taking control of your finances today and work towards a secure financial future.

0 Comments